The discrepancy in prices paid to producers is impacting activity in the present and bringing changes in the future to sugarcane production in Quirinópolis, Goiás. This is the central point of a study commissioned by ADEAGRO (Association of Agricultural Defenders) on the economic forecast for agricultural activity in the region after the problems resulting from the discrepancy in prices practiced in recent harvests.

The report aims to assess the historical profitability of sugarcane suppliers in the Quirinópolis region and compare these indices in different scenarios of productivity, price paid for ATR (Total Recoverable Sugar) and alternative crops, such as soybeans and corn. For this purpose, public information and data provided by Adeagro were used. The study also analyzed different productivity scenarios for producers and contractors in Goiás, in addition to illustrating the production history and the current panorama of alternative crops.

“This study was one of ADEAGRO’s first actions to expand access to information for sugarcane producers in Quirinópolis, providing important data and analyses on the reality of the activity in the region and future prospects. This data is available to our members and is essential for decision-making in upcoming harvests,” says Elizabeth Alves, president of the association.

National positioning and productivity leader

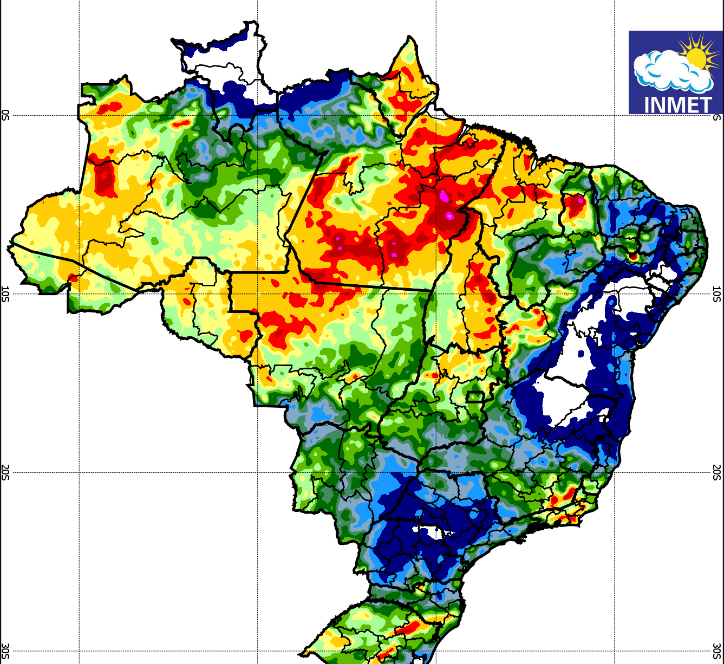

In the first part of the survey, the information focused on analyzing the macro scenario of agricultural crops. Data show that the planted area in Brazil has remained relatively stable over the last 10 years, reaching its peak in the 2016/2017 harvest, when it exceeded 9 million hectares planted. In this scenario, Goiás is the second largest producing state in Brazil, behind São Paulo. Sugarcane production increased by 11.7% between 2014 and 2024, reaching 956 thousand hectares planted in the last harvest. In the 2023/2024 harvest, the volume of sugarcane processed in the state grew by 8.74% compared to 2022/2023. Sugar production in 2022/2023 was 23% higher compared to the volume of the previous harvest, reaching 2.7 million tons.

In the Quirinópolis region, the planted area has grown by approximately 25% in the last 10 years, reaching 259 thousand hectares in 2023/2024. Of this total, sugarcane is the main crop, representing around 70% (180 thousand hectares), which positions the municipality as the second largest sugarcane producer in the state.

Sugarcane production grew by 24% over the last decade, rising from 11.4 million tons in 2013/2014 to 14.1 million tons in 2023/2024. This indicates that, in addition to the increase in the planted area, there was an increase in productivity.

In this regard, Quirinópolis records rates above the state and microregion average. Despite fluctuations in the last five years, local productivity reached 85 tons per hectare in the 2023/24 harvest, an increase of 15% compared to 2021/2022, matching the national average in the current harvest.

“The first part of the study positions the Quirinópolis region as one of the leaders in sugarcane cultivation in Brazil. This data is essential for understanding why, in recent years – and especially in the last harvest – there has been such a significant gap in the amounts paid to producers and why many are migrating to other crops. Soybeans, for example, have been gaining ground, with a 9% increase in market share of the planted area in the last decade. The competent bodies must take effective actions that allow the continuity of agricultural activity”, concludes the president of ADEAGRO.